EBITDA

EBITDA, which stands for Earnings before Interest, Tax, Depreciation, and Amortization, is a metric that is not included in every income statement. It’s the amount left over after deducting the cost of selling, general, and administrative expenditures from the total revenue earned.

Depreciation & Amortization Expense

Accountants construct depreciation and amortization as non-cash expenditures to write down the initial investment in capital assets like PPE over time (PP&E).

Operating Income (or EBIT)

Operating Income is the money brought in by running the firm normally. Put another way, it’s the net gain after revenues have been adjusted for factors like interest and taxes but before any non-operating income or costs have been deducted. Earnings before interest and taxes (abbreviated as “EBIT”) is a frequent financial phrase.

Interest

Cost of Interest. When analyzing a company’s financial performance, it is usual practice to display interest revenue and interest expenditures in their respective sections of the income statement. It’s done this this to square away the gap between EBIT and EBT. The debt schedule is the basis for calculating interest expenditure.

Other Expenses

Other, more specialized costs might arise for businesses. Fulfillment costs, IT costs, R&D costs, stock-based compensation costs, impairment charges, investment sale gains/losses, currency fluctuations, and many other expenditures are possible.

EBT (Pre-Tax Income)

Pre-tax income, or Earnings Before Tax, is calculated by deducting interest costs from operating income. Before calculating net income, this is the last category to add up to.

Income Taxes

When discussing taxes, “income taxes” refer to those levied against after-tax earnings. Total tax cost may include both presently due taxes and those that are projected to become due in the future.

Net Income

After subtracting federal, state, and local taxes from gross revenue, we arrive at net income. After dividends are subtracted, this is the amount that moves into retained profits on the balance sheet.

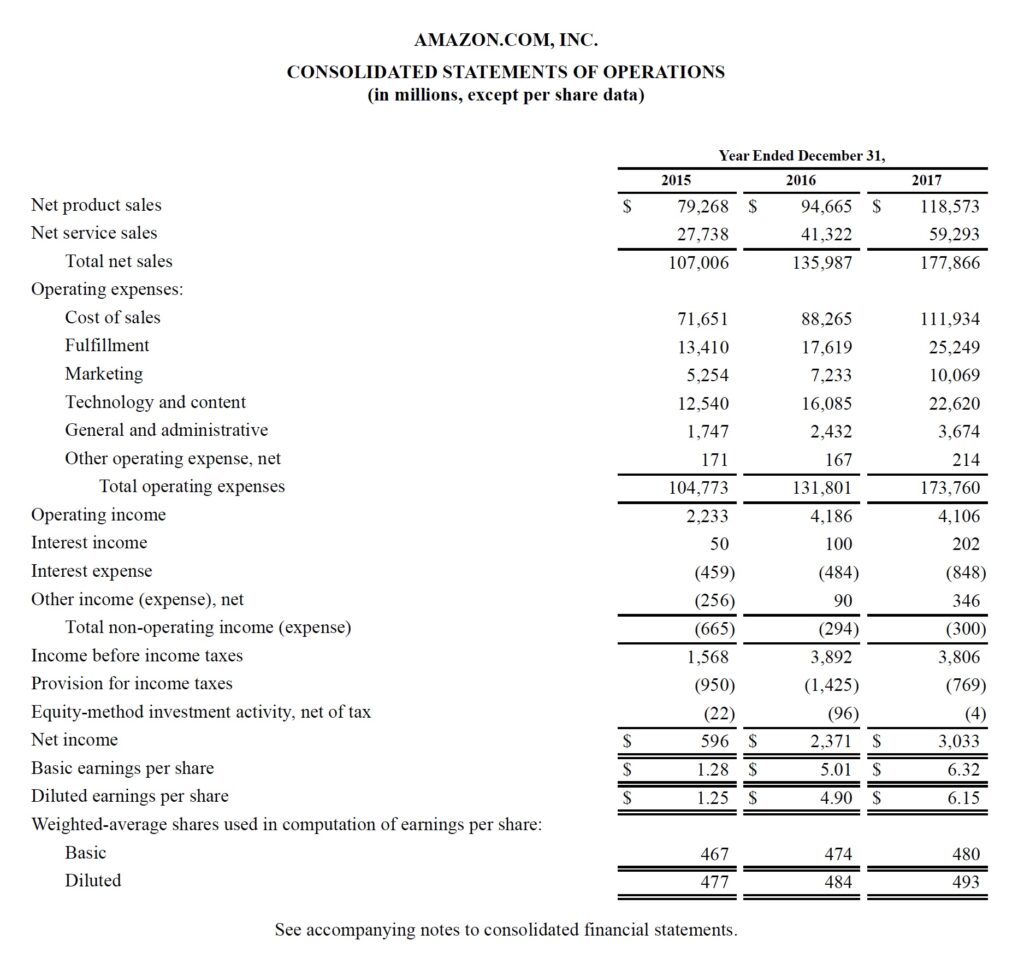

A Real Example of an Income Statement

The financial statements (income statements) for the years 2015–2017 that Amazon has consolidated are displayed here. See the profit and loss statement and get the details down below.

To begin, we can observe that Amazon generates income from the sale of both physical goods and digital services.

As the cost of sales is bundled in with other expenditures such as fulfillment, marketing, technology, content, general and administration (G&A), and other expenses, there is no gross profit subtotal.

Finally, after subtracting all of these costs, we have what is called “Operating Income” on the income statement (also known as EBIT or Earnings Before Interest and Taxes).

Non-operating expenditures, the income tax provision (i.e., future taxes), and equity-method investment activity (profits or losses from minority investments), net of tax, are examples of items that fall below Operating Income that are unrelated to the normal course of business.

When we have the net income (or net loss), we can divide that number by the diluted weighted average number of shares outstanding to get EPS (EPS).